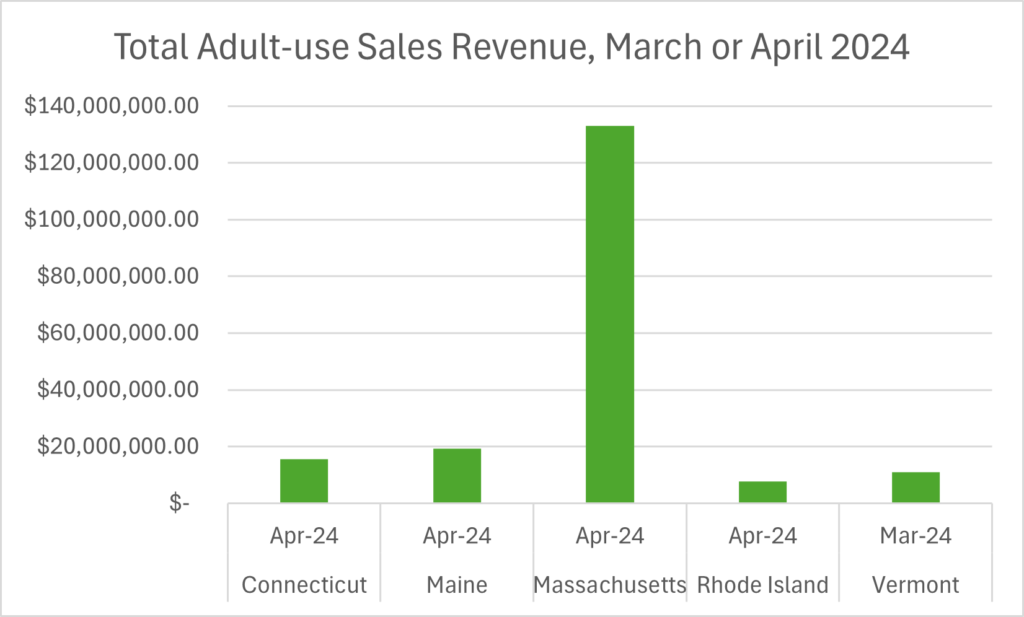

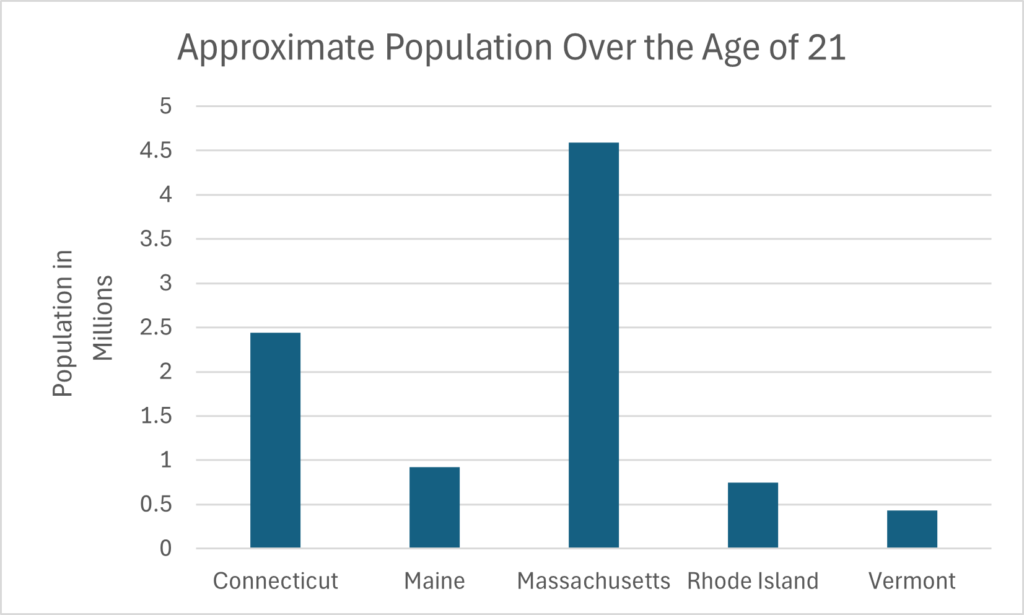

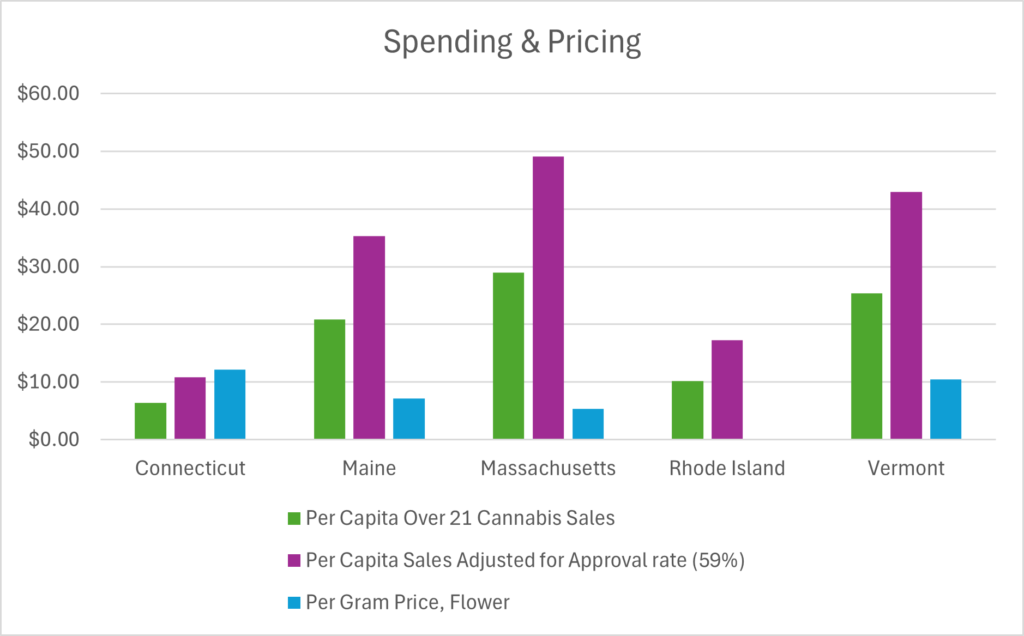

In a quick and dirty breakdown, we compared recent sales data (March or April 2024, depending on availability), for adult-use cannabis in New England. We divided overall adult-use sales by the number of citizens over 21 using the latest demographic data for each state, to compare potential customers to actual sales volume. Then we did it again with a factor for the 59% approval rating of adult-use cannabis nationwide, to roughly reflect actual users. We added in the per-gram price of dry flower, just to give a rough hint as to how much cannabis is actually being produced and consumed in each market. Keep in mind that there are a variety of other demographic factors such as age and socio-economic standing that also inform market performance, and all of these are heavily influenced by the specific regulations in any given state. Before we dive into some of the possible insights from this small data capture, let’s peek at the charts:

The first thing to note is that New Hampshire doesn’t have any data, since they’ve elected to live free or die quite a bit slower than their neighbors. But they’re getting there. We’ll bring them along during a rough calculation for the regional market later.

Beyond that, we can roughly judge the health of a given market by comparing the per capita sales to the average gram price; where we see a larger gram price (Connecticut), the market is likely dealing with supply-side issues. Where several grams could fit into our per capita spending, we know there is a greater level of purchasing occurring and no shortage of supply, with supply-side dynamics typically driving prices lower.

We can also make interesting guesses associated with these dynamics regarding the other factors as mentioned above. Since younger and wealthier communities purchase more cannabis, we can make a guess that states with higher per-capita spending have more populous cities, higher densities of individuals in the 21-65 range, and higher median incomes. If these factors are proportionate and consistent (hint: in the case of New England, they generally are, though Vermont and Maine do take home significantly fewer dollars at the median), it becomes easier to say that higher gram prices and lower sales (Connecticut’s average gram price is over twice that of Massachusetts’!), are indicative of undersupply.

Market Normalization

Most interesting, to me, are the educated guesses based on social media trends and recent media stories pertaining to this region and other nearby markets (read: New York). Given a rocky start for New York’s market–including fielding only 23 adult-use dispensary licensees in the first 2 years of their program–cannabis tourism and smuggling between New York and Massachusetts has become a known issue. But we’re going to set this aside for the sake of staying in New England.

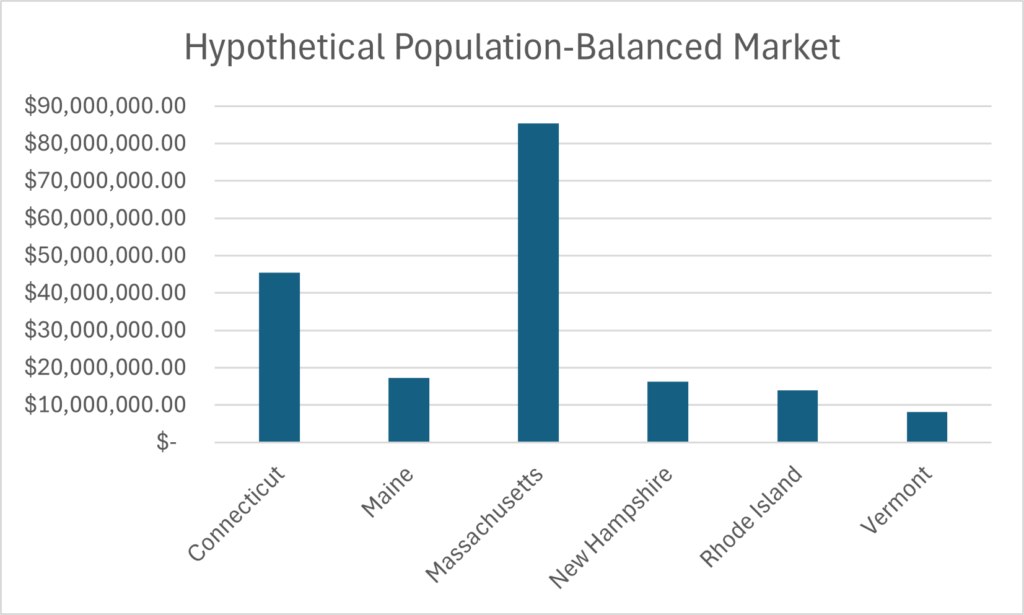

Less obvious, until recent months saw the state’s rampant undersupply hit headlines, is the fact that Connecticut has probably had some influence on the Massachusetts sales dynamic. Severe undersupply from late 2023 into early 2024 has driven the per gram flower price to near-all-time highs in the Constitution State. As we can see in the charts above, Massachusetts’ record sales are disproportionate to the population in the region. Correlating these data points and ignoring the potential influence of New York bordering three of the states in question, we can roughly correct for population across all states to see what complete and equally accessible adult-use markets throughout the region may imply. Doing so we’ll see:

- Rhode Island growing through their rollout in the coming years to almost double recent numbers

- Maine and Vermont normalizing within 5-20% of their present sales levels

- Connecticut’s revenue nearly tripling

- Massachusetts seeing the greatest dollar-value fall during market normalization, from around $120m per month to under $90m a month, a 25%+ drop

This type of market normalization in response to local legalization has seen states like Colorado deal with massive market swings, as a growing-but-plateauing market there around 2019 grew around 50% during the COVID-19 pandemic lockdown period before again normalizing in 2022, decimating businesses as the market lost around $700m in value over less than 18 months. Parallel timing of legalization efforts in New Mexico, Arizona, Missouri, and states farther afield was only just beginning to influence the Colorado cannabis landscape when the COVID bump hit, leading to a form of market whiplash the Northeast can hopefully avoid. As more states legalize, it’s only natural that the cannabis tourism market should fade from Green Rush levels to a more seasonally moderated and normalized pattern parallel to any other local industries and events.

Summing Up This Extremely Basic and Shallow Market Analysis

It’s very kind of states like Massachusetts to make this kind of speculation possible; enthusiastic and progressive cannabis legalization, however messy, allows for a significant impact in a smaller geographical region like New England. Frankly, the fact that their border is permeable to cannabis is the only reason we’re able to guess at the value of the overall market in New England, and even then, our guesses in this analysis don’t factor for plenty of things, including overall market growth; next year’s real sales, if New Hampshire gets up and running by the beginning of 2025, could wildly differ from what we’ve projected here.

We are, however, confident that the New England region will normalize to some extent over time and generally proportionate to the population of eligible buyers in each state. We believe it exceedingly likely that Massachusetts’ market peak is very close, if not passing as we speak, but that remains to be seen. If this is the case, we may very well see oversupply becoming an issue within the next 6-24 months in the Old Colony, though lagging adult-use cannabis programs in Connecticut, Rhode Island, and New Hampshire could inspire some longevity for Massachusetts’ ongoing cannabis boom. We deliberately ignored the black market and its enduring share of the market in this analysis, but expanding access should drive the black market share down, most likely contributing to some of the near-term growth in legal adult-use sales the overall region may see.

Need More?

At Fire Business Strategies, we tend to nerd out a little; we whip up these types of back-of-the-napkin market analyses on the fly to satisfy our own curiosity. Check out our Connecticut cultivation size analysis here. For more in depth looks at regional markets, and to learn how Fire’s services can enhance outcomes for your cannabis business, head on over to our Contact page to set up a free initial consultation.