Minnesota‘s first round of pre-approval social equity applications just closed, so we thought it would be a good idea to look at how the Midwest’s cannabis markets are performing now, revisit a couple states we recently analyzed, and maybe make some wild guesses as to what these markets could look like in the future.

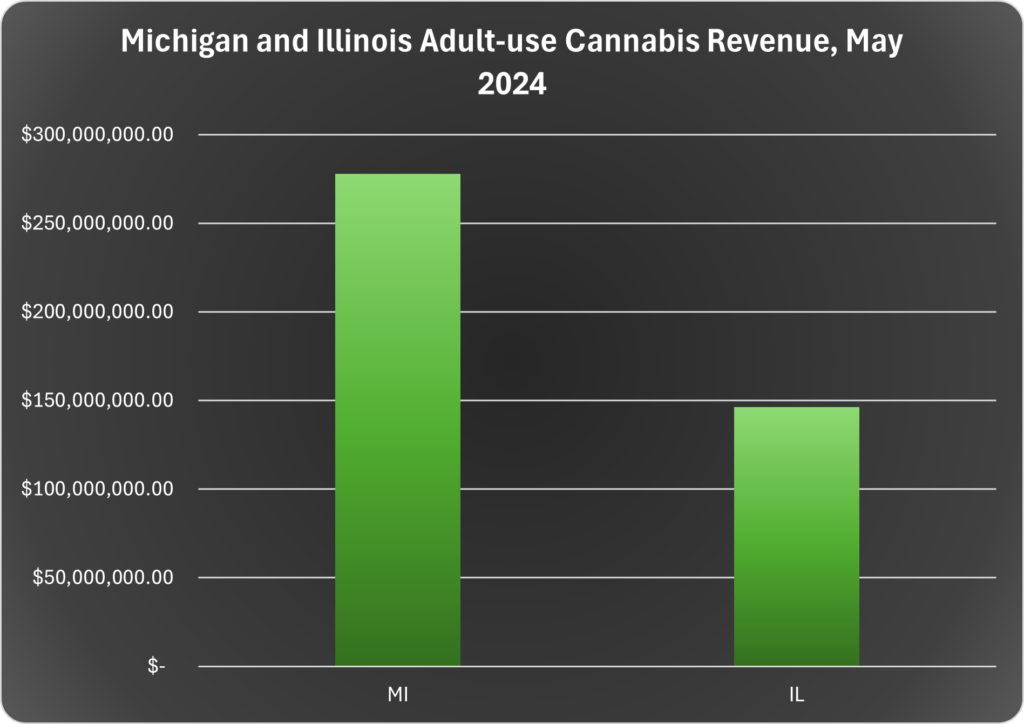

First, we compared recent sales data (May 2024) for adult-use cannabis in Michigan and Illinois, the only Midwest states undertaking adult-use sales prior to August 2024.

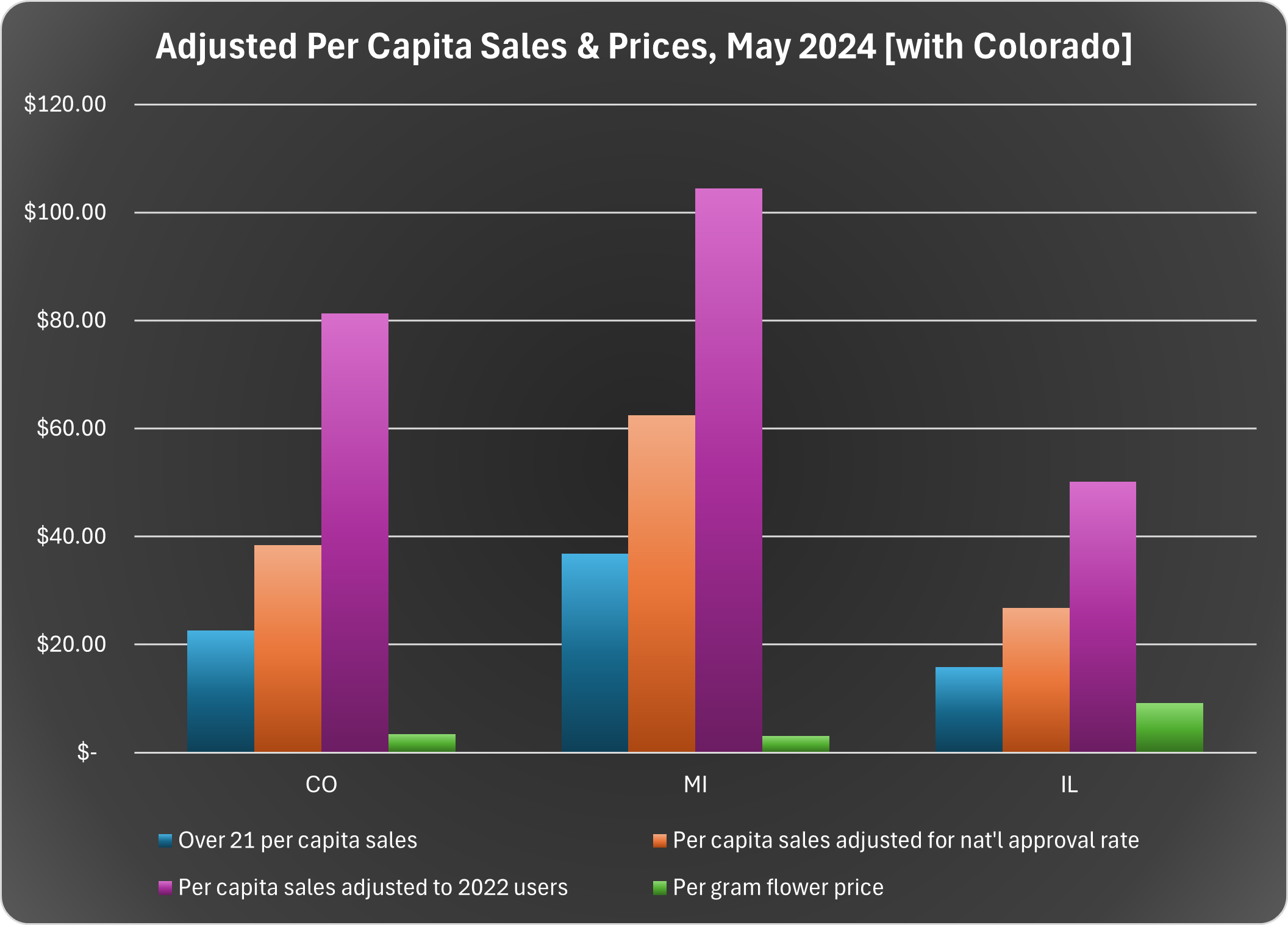

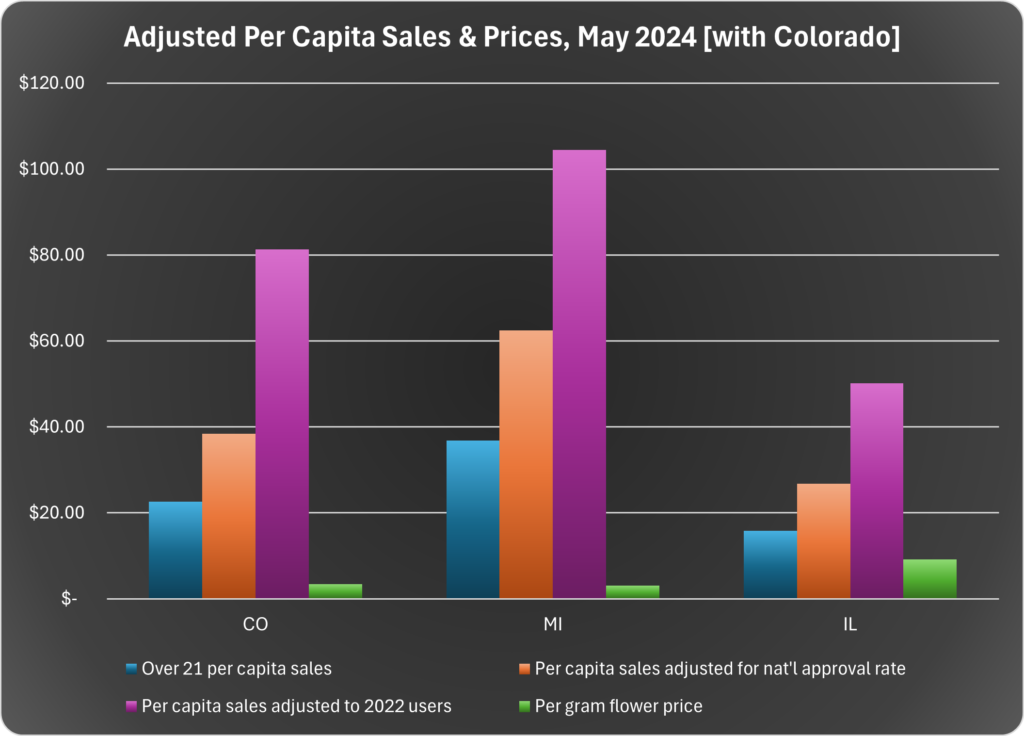

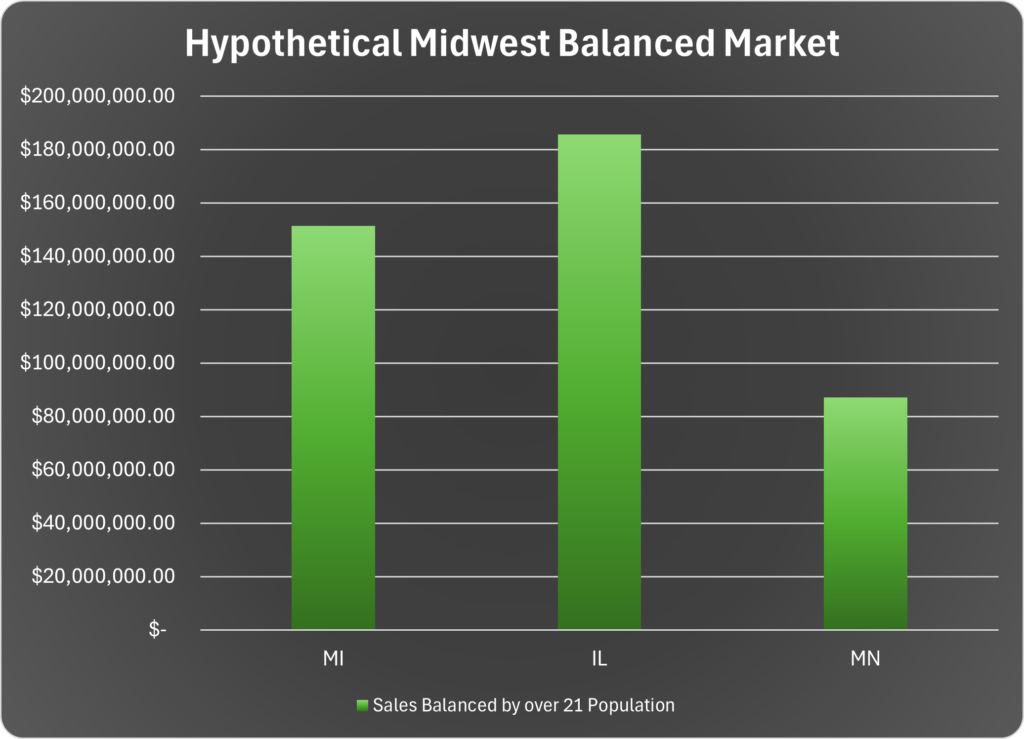

We compared three different slices of the addressable market to determine actual sales volume in these states, first dividing overall adult-use sales by the number of citizens over 21 using the latest census.gov, USAFacts, and World Population Review data for each state. [AT1]

Then we did it again, factoring for the 59% approval rating of adult-use cannabis nationwide, to [very] roughly reflect each state’s maximum potential customer base.

Finally, to visualize a more down-to-earth, addressable market, we factored for each state’s prior year age 18+ cannabis use data from the 2021-2022 National Surveys on Drug Use and Health; with 26.86% and 23.44% of Michigan and Illinois residents reporting using cannabis in the past year, respectively. We factored this result after removing approximately 1.2% of the population–generally the percentage between the ages of 18 and 20 years across all states. Later we’ll revisit Minnesota’s use rate of 23.12% using these factors for a further analysis of market potential.

We also added in the per-gram price of dry flower as reported by MI and IL, just to give a rough hint as to how much actual cannabis is produced and consumed in each market.

Keep in mind that there are a variety of other demographic factors such as age and socio-economic standing that also inform market performance, and all of these are heavily influenced by the specific regulations in any given state. Before we dive into some of the possible insights from this small data capture, let’s peek at the simple revenue data:

A pretty small chart, thanks to lagging legalization efforts and outright criminalization of cannabis in many of the states in the Midwest region.

Digging in deeper, let’s compare per capita sales for persons over 21:

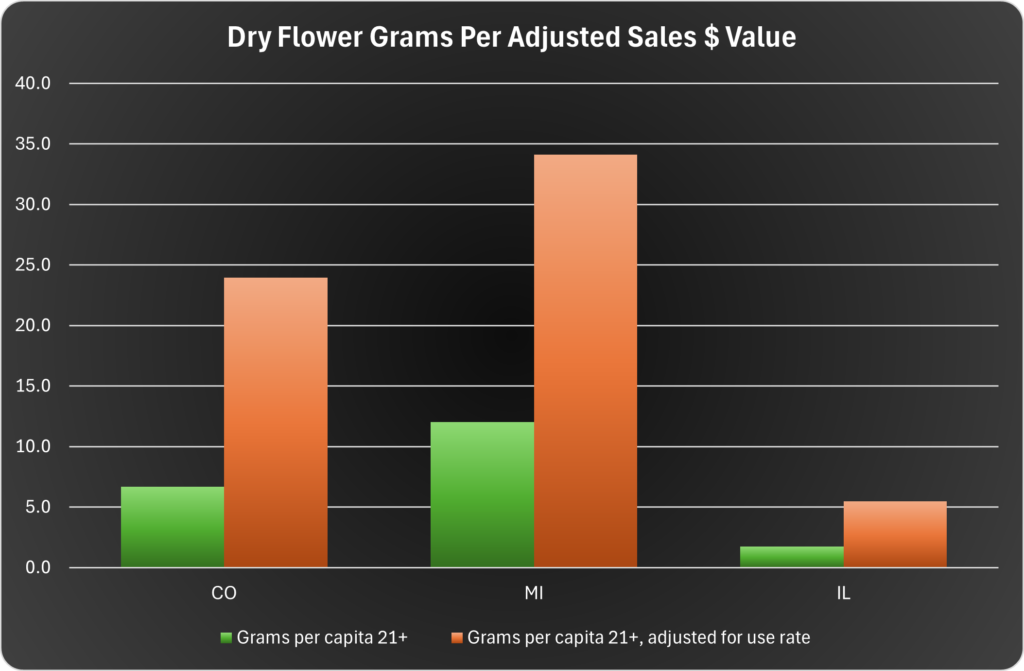

This shows that Michigan’s market is outperforming Illinois’. We added Colorado’s data to see how a maturing market compares. A typical point of comparison we like to check at Fire is how many dry flower grams are represented in the adjusted per capita sales rate:

We see that Michigan, at about 12.0 grams per approval-adjusted capita and 34.0 grams per annual-use-adjusted capita, far outstrips Illinois’ 1.7 grams and 5.5 grams per capita in the same categories.

It’s no surprise then, much like in the Northeast, the math and consumer sentiment are closely aligned across the Midwest. Notably, Reddit posts in communities dedicated to Illinois cannabis are overwhelmingly critical of the state’s industry. The two pinned posts at the top of r/ILtrees are an Axios study regarding Illinois’ high cannabis prices and an Illinois House rep calling for relaxed homegrow regulations, pointing out that the Illinois industry is largely monopolized and stagnating while still charging or fining adults growing cannabis for personal use.

But as anyone who has shopped for cannabis in the Midwest knows, that’s not the whole story, is it?

Almost every inch of Michigan’s borders and coastline to the west, south, and east is made up of borders with states where cannabis is nominally illegal. While it’s not something many of our peers or the local governments like having to acknowledge, the permeability of state borders in the US almost always leads to small-scale trafficking by everyday people looking for accessible, affordable cannabis products. That’s something that goes back to 1996, when California legalized medical marijuana and began to set standards for quality and price that had ramifications across the US, Canada, and Mexico, if not the world, and held water through the wave of adult-use legalization in the decade since Colorado, Oregon, and Washington led that charge. Analyses of these dynamics provide valuable predictive insights about potential market size and other dynamics as we move closer and closer to national-level legalization.

So, what happens when, In the coming months, Minnesota fields a healthy, well-thought-out program? What happens if the Dakotas or Wisconsin follow suit?

Market Normalization

Now we make some very rough but very educated guesses as to the Midwest cannabis market in, say, 2025 or 2026, since some pretty major changes will be necessary for Wisconsin, especially, to legalize adult-use. So, that in mind, we first wanted to see what happens if just Minnesota manages to mooch from Michigan and Illinois’ present pot-based picnic:

Assuming that Michigan is currently feeding a regional market which consists only of Minnesota and some of Illinois in addition to itself, The Great Lake State could lose up to half of its cannabis market to robust cannabis programs in nearby states. Rough for Michigan, to say the least, whose potential monthly revenue would drop by about $100 million.

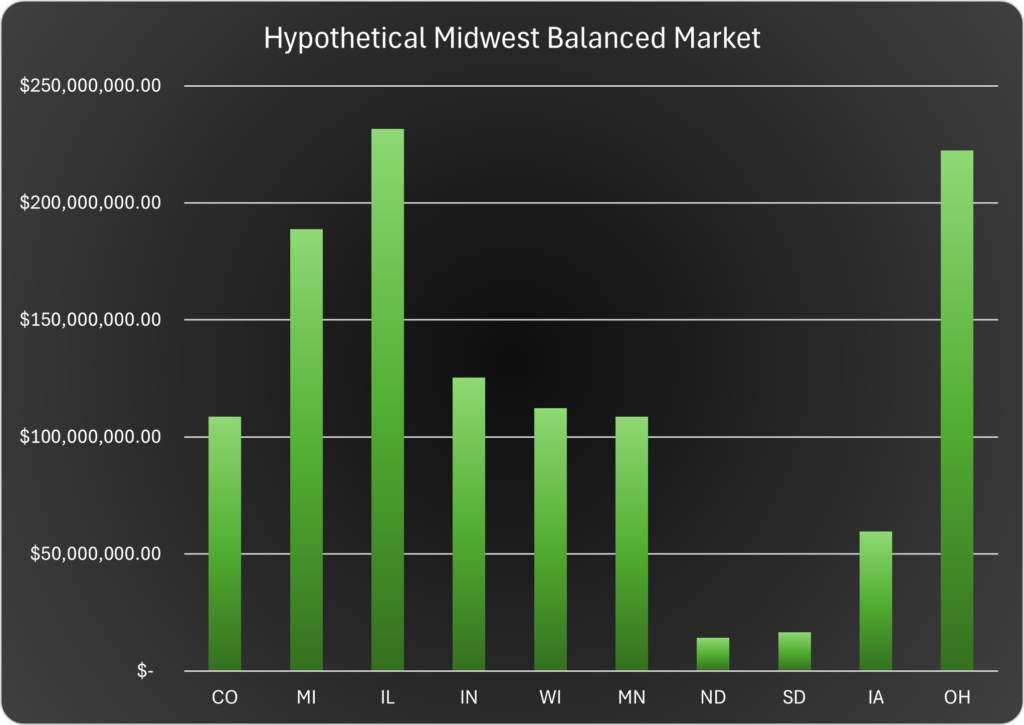

We posit one further scenario, where we average the per-capita cannabis sales across our three example states with sales data, then apply a similar rate of purchasing over the populations of Midwest states participating in or near states participating in legal adult-use sales. We used a rounded $25.00 per potential user 21+ based on the CO, MI, and IL data average:

Okay, let’s pump the brakes for a few disclaimers here. This dynamic is heavily contingent on marked improvements to affordability and accessibility in Illinois if any amount of their current revenue is from out-of-state purchasers. And that’s before the fantasy that is Wisconsin or Indiana making any major moves in the next couple years. We also don’t factor in any price compression or population growth in this simplified analysis.

Further, we go back to Reddit, where we’ve seen users self-report traveling to Michigan from as far away as Kentucky and Virginia. Clearly, the market with the lowest possible prices will win customers from fairly far afield.

While this hypothetical dynamic does highlight Michigan’s absolute nightmare scenario–even worse than the already clear-and-present threat that is Ohio’s transition to adult-use last week, it also highlights that Minnesota’s program has a strong chance to be remarkably stable; at its full potential in our projections there is only a 20% difference between eating Michigan’s lunch in the next couple of years and a completely legalized, potentially more population-balanced regional market.

This type of market normalization in response to regional legalization has seen states like Colorado deal with massive market swings, as a growing-but-plateauing market there around 2019 grew around 50% during the COVID-19 pandemic lockdown period before again normalizing by 2023, decimating businesses as the market gained and lost around $700m in value over less than 36 months. Parallel timing of legalization efforts in New Mexico, Arizona, Missouri, and states farther afield was only just beginning to influence the Colorado cannabis landscape when the COVID bump hit, leading to a form of market whiplash the Midwest can hopefully avoid. As more states legalize, it’s only natural that the cannabis tourism market should fade from Green Wave levels to a more seasonally moderated and normalized pattern parallel to any other local industries and events.

Summing Up This Extremely Basic and Shallow Market Analysis

Notably, this analysis completely excludes any illicit or black-market cannabis sales that may be ongoing, and the overall cannabis market does continue to grow year-over-year. That means our ‘balanced market’ is potentially—if not probably—off by over 10% for any given state, especially since our market projection using estimated per-capita sales is likely to be extremely dynamic in new markets for the first 2-3 years (remember we include our least frequent fliers in that measurement, though). We also ignore cultural and regulatory differences that exist now or may come to pass.

Even beyond that, a healthy market with broad selection and low prices in Michigan could mean out-of-staters will still head there to make their purchases indefinitely, local markets be damned. Conversely, Minnesota is surrounded by illegal states, for now, and taking in even 10% of those potential markets could lead to around $5 million in additional monthly sales at our use-rate adjusted extimate.

It’s also notable that the demographics of 21–65-year-olds and median income statistics are remarkably consistent over the states we compared here, averaging around 57% in that age group and with an average median income across all states of $70,649.00 +/- $4,028.69, meaning we shouldn’t see major differences in individual buying power across the region, either.

Overall, the regional volatility in the Great Lakes and greater Midwest is intense, and if trends continue it’ll only get more competitive. We expect lots of opportunity for revenue generation in Minnesota, but the states that are lagging may never see markets that develop like Michigan, and Illinois is a case study in what not to do (did we mention they put up these weak numbers despite having 22% more adults than Michigan, too? You’d at least think Illinois could win one metric. Maybe they can go back in time and get Ditka and the ’85 Bears squad to do something about it.)

At Fire Business Strategies, we tend to nerd out a little; we whip up these types of back-of-the-napkin market analyses on the fly to satisfy our own curiosity. For more in depth looks at regional markets, and to learn how Fire’s services can enhance outcomes for your cannabis business, head on over to our Contact page to set up a free initial consultation.